Public Safety Canada Quarterly Financial Report

For the quarter ended June 30, 2011

Table of contents

- 1.0 Introduction

- 1.1 Authority, Mandate and Program Activities

- 1.2 Basis of Presentation

- 1.3 Public Safety Canada Financial Structure

- 2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

- 2.1 Significant Changes to Authorities

- 2.2 Explanations of Significant Variances from Previous Year Expenditures

- 3.0 Risks and Uncertainty

- 4.0 Significant Changes in Relation to Operations, Personnel and Programs

- 5.0 Statement of Authorities (unaudited)

- 6.0 Departmental Budgetary Expenditures by Standard Object (unaudited)

1.0 Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board Accounting Standard 1.3. This quarterly financial report should be read in conjunction with the Main Estimates and Supplementary Estimates (A) of 2010-11 and the Main Estimates for 2011-12, as no Supplementary Estimates (A) were tabled for the Department in the current fiscal year. This quarterly financial report has not been subject to an audit or review.

1.1 Authority, Mandate and Program Activities

Public Safety (PS) Canada plays a key role in discharging the Government's fundamental responsibility for the safety and security of its citizens. The Department of Public Safety and Emergency Preparedness Act 2005 and the Emergency Management Act 2007 set out two essential roles for the Department: (i) support the Minister's responsibility for all matters, except those assigned to another federal minister, related to public safety and emergency management, including national leadership; and (ii) coordinate the efforts of Public Safety's Portfolio agencies, as well as provide guidance on their strategic priorities.

The Department provides strategic policy advice and support to the Minister of Public Safety on a range of issues, including: national security; border strategies; countering crime; and emergency management. The Department also delivers a number of grant and contribution programs related to emergency management and community safety.

Further information on the mandate, roles, responsibilities and programs of Public Safety Canada can be found in the 2011-12 Main Estimates and Report on Plans and Priorities at 2011-12 Part I, II and III - Main Estimates.

1.2 Basis of Presentation

This quarterly report has been prepared by management using an expenditure basis of accounting (modified-cash). The accompanying Statement of Authorities includes the Department's spending authorities granted by Parliament and those used by the Department consistent with the Main Estimates for the 2011-2012 fiscal year. This statement is also being presented using a special purpose financial reporting framework designed to meet financial information needs with respect to the use of spending authorities.

The authority of Parliament is required before moneys can be spent by the Government. Approvals are given in the form of annual limits provided through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a Special Warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A Special Warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Department uses the full accrual method of accounting to prepare and present its annual departmental financial statements as presented in the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis as do the expenditures presented in this report.

1.3 Public Safety Canada Financial Structure

Public Safety Canada has a financial structure composed mainly of voted budgetary authorities that include Vote 1 - Operating Expenditures and Vote 5 - Grants and Contributions, while the statutory authorities comprise the Contributions to employee benefits plans and Minister's Salary and motor car allowance.

Over 60 percent of the Department's budget is devoted to delivering grants and contributions programs related to emergency preparedness, and community safety. The largest programs include payments made pursuant to the Disaster Financial Assistance Arrangements (DFAA) which is quasi-statutory in nature, programming related to the implementation of the National Crime Prevention Strategy (NCPS), and the First Nations Policing Program (FNPP). In recent years, the Department has also been called to manage requirements under the Security Cost Framework Policy for contribution funding to reimburse provincial/territorial and municipal security partners for extraordinary justifiable and reasonable incremental policing and security-related expenses incurred in relation to Prime Minister and Minister-led events in Canada such as G8/G20 summits.

2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

The numbers presented in the report are in accordance with the Government Wide Chart of Accounts for Canada of 2011-12 and the Treasury Board Accounting Standard (TBAS) 1.3.

2.1 Significant Changes to Authorities

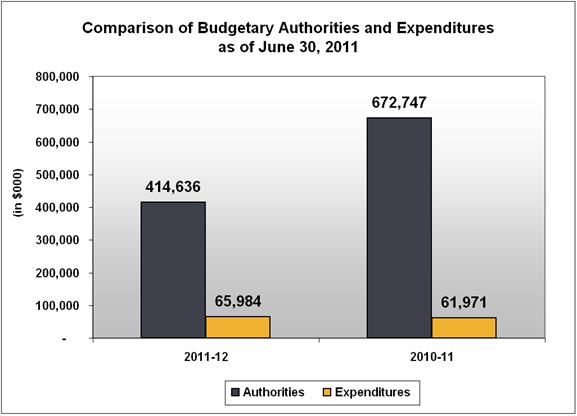

Please note that for the period ending June 30, 2010, the authorities' level provided to the Department include both the Main Estimates and Supplementary Estimates (A); whereas, the 2011-12 authorities for the same period are provided strictly through the Main Estimates for that fiscal year as no Supplementary Estimates (A) were tabled for the Department for this fiscal year. The attached Statement of Authorities reflects a net decrease of $258.1 million in Public Safety Canada's total authorities at June 30, 2011 compared to those of the previous year for the same period, from $672.7 million to $414.6 million.

This net decrease is a combination of decreases in Vote 1 - Operating Expenditures ($2.9 million) and Vote 5 - Grants and Contributions ($255.8 million), and an offset increase in Budgetary Statutory Authorities ($0.6 million).

Vote 1 - Operating Expenditures

The Department's Vote 1 net decrease of $2.9 million or 2.1% is explained as follows:

- Increases to reflect new funding approvals:

- Implementation of Canada's Cyber Security Strategy to protect digital infrastructure ($7.2 million)

- Management of Immigration Cases involving classified information under Division 9 of the Immigration and Refugee Protection Act ($0.5 million)

- Concrete Actions on Missing and Murdered Aboriginal Women ($0.4 million)

- Adjustment to reflect the transfer of funding to other government departments factored in the authorities of 2010-11 that have not taken place in 2011-12 ($0.4 million)

- Decreases to reflect a reduction or the end of funding (sunsetting or one-time):

- Emergency Management Capacity within Public Safety ($3.8 million)

- G8/G20 Summits ($1.8 million)

- Youth Gang Prevention Fund ($1.2 million)

- Short-Term Sustainability of Policing Agreements and Comprehensive Program Review of the First Nations Policing Program ($0.6 million)

- Decreases related to the 2009 Strategic Review Savings ($2.8 million)

- Decreases resulting from Budget 2010 Cost Containment Measures ($0.8 million)

- Decreases to the operating budget of the Minister's Office ($0.4 million)

The combined adjustments result in a net $2.9 million decrease of Vote 1 - Operating Expenditures' authorities in the first quarter of operation for 2011-12.

Vote 5 - Grants and Contributions (G&C)

The Department's Vote 5 net decrease of $255.8M or 49.2% is mainly explained as follows:

- Increases to reflect new funding approvals:

- Contribution agreements with the provinces of Ontario and Quebec to support the Biology Casework Analysis ($6.9 million)

- Aboriginal Community Safety Development Contribution Program ($0.5 million)

- Increases to adjust the transfer of funding to the RCMP of $35.0 million for the cost of First Nations Policing reflected in the 2010-11 Supplementary Estimates and not yet adjusted in the 2011-12 authorities

- Decreases to reflect a reduction or the end of funding (sunsetting or one-time)

- G8/G20 Summits ($260.8 million)

- Youth Gang Prevention Fund ($6.1 million)

- Short-Term Sustainability of Policing Agreements and Comprehensive Program Review of the First Nations Policing Program ($19.3 million)

- Haïti Repatriation of Canadians following the January 2010 earthquake ($1.5 million)

- Decreases related to the 2009 Strategic Review Savings ($10.3 million)

The combined adjustments result in a net $255.8 million decrease of Vote 5 - Grants and Contributions' authorities in the first quarter of operation for 2011-12.

Budgetary Statutory Authorities

The 2011-12 statutory authorities' level in the first quarter reports no appreciable change compared to 2010-11. The increase of $0.6 million is related to the Employee Benefit Plans (EBP) costs associated with the change in the Department budgetary requirements for salary.

Image Description

This graph provides a comparison of the budgetary authorities and expenditures as of June 30, 2011 and June 30, 2010 for the Department's combined Vote 1, Vote 5 and Statutory Votes. The "first" column in the graph starting from the left indicates that for the 2011-12 fiscal year the Department authorities' levels are at $414.636 million. The "third" column in the graph depicts the 2010-11 authorities which were at $672.747 million. The expenditures reported at end of the first quarter for the 2011-12 fiscal year of $65.984 million are shown under the "second" column. The PS actual expenditures incurred in 2010-11 were $61.971 million and are shown under the "fourth" column.

2.2 Explanations of Significant Variances from Previous Year Expenditures

Compared to the previous year, the total gross expenditures in the first quarter, ending June 30, 2011, have increased by $4.0 million, from $61,971 million to $65,984 million as per the Table of Departmental Budgetary Expenditures by Standard Object. This represents an increase of 6.5% against expenditures recorded for the same period in 2010-11. This difference is for the most part explained by increases of expenditures in Personnel of $2.7 million and Transfer Payments of $2.0, and a reduction of $0.7 million in spending under the other operating costs.

Personnel expenditures have increased by $2.7 million from $23.8 million in the first quarter of 2010-11 to $26.5 million as of June 30, 2011. This increase of 11.3% is a result of salary cost increases associated with additional usage of personnel to support departmental programs in comparison to the first quarter of last year. The impact of the recently negotiated collective agreements is also contributing to this increase.

The $2.0 million increase in Transfer Payment expenditures in the first quarter of 2011-12 is mainly due to additional contributions made under the Biology Casework Analysis Program ($3.4 million) and the National Crime Prevention Strategy Program ($1.4 million) which are counter balanced by a decrease in the rate of spending under the First Nations Policing Program ($2.7 million).

The reductions in the rate of spending noted under the other operating costs for Professional and Special Services ($0.487 million) and Transportation and Communications ($0.219 million) are mainly attributable to a planned reduction of the level of activity for initiatives in support of emergency management.

Under Acquisition of Machinery and Equipment, the Department spent $0.266 million to mainly acquire IT related equipment for security networking during the period ended June 30, 2011; whereas, nothing was expended under this standard object for the same period in fiscal year 2010-11. This expenditure increase is counter balanced by decreases under a number of other budgetary expenditures.

3.0 Risks and Uncertainty

The Department's mandate spans from public safety and security, intelligence and national security functions, social interventions for youth at risk, to readiness for all manner of emergencies. The Department is called to rapidly respond to emerging threats and ensure the safety and security of Canadians. The Department's ability to deliver its programs and services is subject to several risk sources such as the rapidly changing threat environment, its ability to respond to natural or man-made disasters, government priorities, and central agencies or government-wide initiatives. To deliver this mandate effectively, the collaboration of many departments and agencies, provincial and territorial governments, international partners, the private sector and first responders is required. Without the collaboration of all these partners, the Department is at risk in the delivery of its mandate and objectives, making the effectiveness of these relationships crucial.

Public Safety Canada is currently facing a number of pressures against its authorities irrespective of the future savings implications likely to result from the Strategic and Operating Review (SOR) exercise. The Budget 2010 Cost Containments Measures will require the Department to finance, on a permanent basis, the costs of wage increases resulting from current and future collective agreements negotiated between 2010-11 and 2012-13; whereas, the Administrative Services Review (ASR) may bear future impacts on the organization and delivery of corporate services. The implementation of these efficiency measures is likely to have an impact on the Department's workforce.

The ongoing impact of the 2009 Strategic Review savings and the Budget 2010 Cost Containment Measures coupled with the new request to reallocate funds out of its existing authorities to meet emerging priorities will likely further pressure the Department's envelope. This may limit the flexibility to reallocate funding to achieve the expected results.

In recognition of this tightening fiscal environment, Public Safety Canada will continue to examine all of its departmental program spending, making reallocations against identified priorities. The Department needs to continue to explore actions to mitigate and manage the impact of these efficiencies measures in order to achieve best results for Canadians.

4.0 Significant changes in relation to operations, personnel and programs

External Reporting

With the approval in 2010-11 of the Policy on Financial Resource Management, Information and Reporting, the resulting amendment of the Treasury Board Accounting Standard (TBAS) 1.3, and the new Directive on the Management of Travel, Hospitality and Conferences, new requirements for the reporting of financial information have been placed on departments.

These policies/directives now require departments to produce auditable financial statements, comprehensive Future Oriented Financial Statements and Quarterly Financial Reports, and a comparative annual report on travel, hospitality and conferences expenditures. These have resulted on more requirements being placed on existing departmental personnel to retrieve, consolidate and produce these reports.

Transformation of Pay Administration

The Consolidation of Pay Services Project was approved by Treasury Board Ministers in June 2009 as part of the Transformation of Pay Administration Initiative. The Project will consolidate pay services from participating departments and agencies (organizations) that currently use, or are planning to use, the endorsed Government of Canada Human Resources Management System (PeopleSoft). The implementation strategy is expected to take effect starting in 2011-12 and call for a gradual transfer of work and funding that is proportionate to the number of accounts being serviced for the Department. The Department's reference levels will be adjusted progressively as pay services are consolidated to PWGSC.

Regional Transformation

An objective of the regional transformation is to strengthen the overall contribution of the Department's regional offices. In keeping with the principle of enhancing collaboration within and across regions and headquarters, the Department's regional presence will fully integrate the regional offices into departmental operations, and enhance program and service delivery. In order to streamline the reporting structure for the Department's regional presence, all regional operations will be reporting through a single branch. The structure will provide new opportunities for our regional offices to become increasingly engaged in making contributions on the full range of departmental priorities.

Program Activity Architecture

A revised Program Activity Architecture (PAA) was introduced in 2011-12. The Department streamlined its PAA by regrouping the previous eight program activities into five. The revised PAA is supported by a new Performance Measurement Framework (PMF). Public Safety has implemented new measurement practices in 2011-12 to assess its performance against results. The PMF serves as a foundational piece in supporting a results-based management culture.

Approval by Senior Officials:

Deputy Minister

Ottawa, Ontario

Chief Financial Officer

Ottawa, Ontario

Date signed: August 12, 2011

| Fiscal year 2011-2012 | Fiscal year 2010-2011 | ||||||

|---|---|---|---|---|---|---|---|

| Total available for use for the year ending | Used during the quarter ended | Year to date used at quarter end | Total available for use for the year ending | Used during the quarter ended | Year to date used at quarter end | ||

| 31/03/2012* | June 30, 2011 | June 30, 2011 | 31/03/2011* | June 30, 2010 | June 30, 2010 | ||

| Vote 1 - Operating expenditures | 136,709 | 27,686 | 27,686 | 139,647 | 25,858 | 25,858 | |

| Vote 5 - Grants and contributions | 263,562 | 34,707 | 34,707 | 519,318 | 32,668 | 32,668 | |

| Budgetary statutory authorities | 14,365 | 3,591 | 3,591 | 13,782 | 3,445 | 3,445 | |

| TOTAL AUTHORITIES | 414,636 | 65,984 | 65,984 | 672,747 | 61,971 | 61,971 | |

*Includes only authorities available for use and granted by Parliament at quarter-end

Note: Totals may not add and may not agree with details provided elsewhere due to rounding.

| Fiscal year 2011-2012 | Fiscal year 2010-2011 | ||||||

|---|---|---|---|---|---|---|---|

| Planned expenditures for the year ending | Expensed during the quarter ended | Year to date used at quarter end | Planned expenditures for the year ending | Expensed during the quarter ended | Year to date used at quarter end | ||

| 31/03/2012* | June 30, 2011 | June 30, 2011 | 31/03/2011* | June 30, 2010 | June 30, 2010 | ||

| Expenditures: | |||||||

| Personnel | 93,742 | 26,497 | 26,497 | 94,608 | 23,805 | 23,805 | |

| Transportation and communications | 10,583 | 1,112 | 1,112 | 9,991 | 1,331 | 1,331 | |

| Information | 2,154 | 117 | 117 | 4,456 | 187 | 187 | |

| Professional and special services | 28,666 | 1,885 | 1,885 | 29,245 | 2,372 | 2,372 | |

| Rentals | 7,023 | 1,143 | 1,143 | 9,417 | 1,253 | 1,253 | |

| Repair and maintenance | 1,055 | 144 | 144 | 1,406 | 114 | 114 | |

| Utilities, material and supplies | 2,052 | 99 | 99 | 1,351 | 132 | 132 | |

| Acquisition of land, buildings and works | 208 | - | - | - | - | - | |

| Acquisition of machinery and equipment | 5,491 | 266 | 266 | 2,873 | - | - | |

| Transfer payments | 263,562 | 34,707 | 34,707 | 519,318 | 32,668 | 32,668 | |

| Public debt charges | - | - | - | - | - | - | |

| Other subsidies and payments | 100 | 13 | 13 | 83 | 109 | 109 | |

| Total budgetary expenditures | 414,636 | 65,984 | 65,984 | 672,747 | 61,971 | 61,971 | |

*Includes only authorities available for use and granted by Parliament at quarter-end

Note: Totals may not add and may not agree with details provided elsewhere due to rounding.

- Date modified: