Public Safety Canada Quarterly Financial Report

For the quarter ended September 30, 2012

Table of contents

1.0 Introduction

This quarterly financial report has been prepared by management as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board Accounting Standard 1.3. This quarterly financial report should be read in conjunction with the Main Estimates, Supplementary Estimates (A) for 2012-13 as well as the Main Estimates for 2011-12. No Supplementary Estimates (A) was tabled or Eligible Paylist Expenditures received by the Department in the first quarter of 2011-12. This quarterly financial report has not been subjected to an audit or review.

1.1 Authority, Mandate and Program Activities

Public Safety (PS) Canada plays a key role in discharging the Government's fundamental responsibility for the safety and security of its citizens. The Department of Public Safety and Emergency Preparedness Act 2005 and the Emergency Management Act 2007 set out two essential roles for the Department: (i) support the Minister's responsibility for all matters, except those assigned to another federal minister, related to public safety and emergency management, including national leadership; and (ii) coordinate the efforts of PS's Portfolio agencies, as well as provide guidance on their strategic priorities.

The Department provides strategic policy advice and support to the Minister of PS on a range of issues, including: national security, border strategies, countering crime and emergency management. The Department also delivers a number of grant and contribution programs related to countering crime and emergency management.

Further information on the mandate, roles, responsibilities and programs of PS can be found in the 2012-13 Main Estimates and Report on Plans and Priorities at 2012-13 Part I and II - Main Estimates.

1.2 Basis of Presentation

This quarterly report has been prepared using an expenditure basis of accounting (modified-cash). The accompanying Statement of Authorities includes the Department's spending authorities granted by Parliament, or received from Treasury Board Central Votes, and those used by the Department consistent with the Main Estimates and the Supplementary Estimates (A) for the 2012-13 fiscal year. This statement is also being presented using a special purpose financial reporting framework designed to meet the information needs concerning the use of spending authorities.

The authority of Parliament is required before funds can be spent by the Government. Approvals are given in the form of annual limits provided through Appropriation Acts or through legislation in the form of statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act (FAA) authorizes the Governor General, under certain conditions, to issue a Special Warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A Special Warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The Department uses the full accrual method of accounting to prepare and present its departmental financial statements as presented through Part III of the estimates process. However, the spending authorities voted by Parliament remain on an expenditure basis, as do the expenditures presented in this report.

As part of the Parliamentary business of supply, the Main Estimates must be tabled in Parliament on or before March 1 preceding the new fiscal year. Budget 2012 was tabled in Parliament on March 29, after the tabling of the Main Estimates on February 28, 2012. As a result the measures announced in the Budget 2012 could not be reflected in the 2012-13 Main Estimates.

In fiscal year 2012-13, frozen allotments will be established by Treasury Board authority in departmental votes to prohibit the spending of funds already identified as savings measures in Budget 2012. In future years, the changes to departmental authorities will be implemented through the Annual Reference Level Update (ARLU), as approved by Treasury Board, and reflected in the subsequent Main Estimates tabled in Parliament.

1.3 Public Safety Canada Financial Structure

PS has a financial structure composed mainly of voted budgetary authorities that include Vote 1 - Operating Expenditures, Vote Netting Revenue and Vote 5 - Grants and Contributions, while the statutory authorities comprise the Contributions to employee benefit plans and Minister of PS - Salary and motor car allowance.

Over 60 percent of the Department's budget is devoted to delivering transfer payment programs related to national security, countering crime and emergency preparedness. The largest programs include payments made pursuant to the First Nations Policing Program (FNPP), the Disaster Financial Assistance Arrangements (DFAA) and programming related to the implementation of the National Crime Prevention Strategy (NCPS).

2.0 Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

The numbers presented in the report are in accordance with the Government-Wide Chart of Accounts for Canada for 2012-13 and Treasury Board Accounting Standard (TBAS) 1.3.

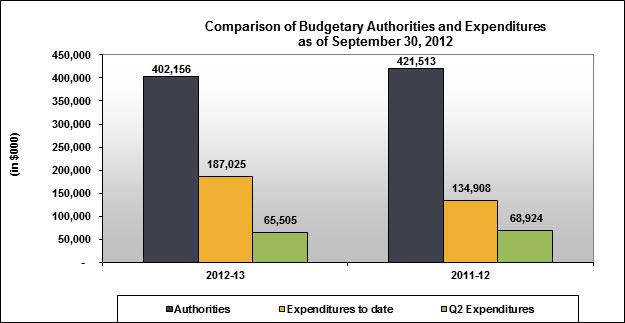

The following graph provides a comparison of the budgetary authorities and expenditures as of September 30, 2012 and September 30, 2011 for the Department's combined Vote 1, Vote 5 and Statutory Votes.

Image Description

Starting from the left hand side, the "first" column in the graph indicates that the Department authorities are at $402.2 million for fiscal year 2012-13. The year-to-date expenditures of $187.0 million reported at the end of the second quarter of the 2012-13 fiscal year are shown under the "second" column. The expenditures of $65.5 million for the period ended September 30, 2012 (i.e. second quarter) are presented under the "third" column. The fourth column in the graph depicts the 2011-12 authorities which were at $421.5 million at the end of September 2011. The 2011-12 year-to-date expenditures of $134.9 million are shown under the "fifth" column. The PS' actual expenditures incurred in the second quarter of 2011-12 were $68.9 million and are shown under the "sixth" column of the graph.

2.1 Significant Changes to Authorities

For the period ending September 30, 2012, the authorities provided to the Department included the Main Estimates, the Supplementary Estimates (A), TB Central Votes (2011-12 Carry-Forward and Eligible Paylist Expenditures) whereas, the 2011-12 authorities for the same period are provided strictly through the Main Estimates and TB Central Votes (2010-11 Carry-Forward). No Supplementary Estimates (A) was tabled or Eligible Paylist Expenditures received by the Department in the second quarter of 2011-12. The attached Statement of Authorities reflects a net decrease of $19.4 million in PS's total authorities at September 30, 2012 compared to those of the previous year for the same period (from $421.5 million to $402.2 million).

This net decrease in the authorities available for use is a combination of a decrease in Vote 1 - Operating Expenditures ($8.5 million), a decrease in Vote 5 - Grants and Contributions ($11.6 million), partially offset by an increase in Budgetary Statutory Authorities ($0.7 million).

Vote 1 - Operating Expenditures

The Department's Vote 1 decreased by $8.5 million or 5.9%, which is mainly due to:

- An increase of $3.0 million for funding to strengthen the security of federal cyber systems;

- An increase of $1.1 million for the renewal of funding to support activities related to the solicitation, development and delivery of targeted prevention interventions aimed at reducing youth violence and youth gangs among those most at risk;

- An increase of $0.9 million for the Kanishka Project Research Initiative;

- An increase of $0.9 million for the renewed funding to maintain the standard of delivery of, and engage in the new activities under the Continuity of Government program;

- An increase of $0.6 million for the reimbursement of Eligible Paylist Expenditures in 2012-13;

- A decrease of $8.3 million for the transfer to Shared Services Canada;

- A decrease of $2.5 million due to the net results of reprofiling funds between various fiscal years for Emergency Management Capacity;

- A decrease of $1.8 million due to the conversion factor for Employee Benefit Plans (EBP) related to a transfer from Other Operating Costs to Personnel;

- A decrease of $1.4 million due to the sunsetting of a reprofile for Urban Transit Exercises; and

- A decrease of $0.6 million as a result of the 2009 Strategic Review.

Vote 5 - Grants and Contributions (G&C)

The Department's Vote 5 decreased by $11.6M or 4.4%, which is mainly due to:

- An increase of $15.0 million for the sustainability of agreements under the First Nations Policing Program;

- An increase of $7.9 million for the Ex Gratia payments to the families of the victims of Air India Flight 182;

- An increase of $6.1 million for the renewal of funding to support activities related to the solicitation, development and delivery of targeted prevention interventions aimed at reducing youth violence and youth gangs among those most at risk;

- An increase of $1.0 million for the Kanishka Project Research Initiative;

- A decrease of $41.0 million as a result of a transfer to the Royal Canadian Mounted Police for the First Nations Community Policing Services; and

- A decrease of $0.9 million as a result of the 2009 Strategic Review.

Budgetary Statutory Authorities

The increase of $0.7 million in 2012-13 is related to the Employee Benefit Plans (EBP) costs associated with the change in the Department budgetary requirements for salary. This does not represent a material change compared to 2011-12.

2.2 Explanations of Significant Variances from Previous Year Expenditures

The total year-to-date (YTD) expenditures increased by $52.1 million or 38.6% in 2012-13, compared to 2011-12, from $134.9 million to $187.0 million. This increase is mostly due to higher spending in Transfer Payments, which increased by $61.3 million or 94.8% from $64.7 million in 2011-12 to $126.0 million in 2012-13. For a detailed explanation of variances in expenditures in Quarter 1, please refer to the first quarterly report for 2012-13. The cumulative effect of these variances, as well as the variances in the second quarter detailed below, explain the increase in YTD expenditures.

Compared to the previous year, the total expenditures in the second quarter, ending September 30, 2012, have decreased by $3.4 million, from $68.9 million to $65.5 million as per the Table of Departmental Budgetary Expenditures by Standard Object. This represents a decrease of 5.0% against expenditures recorded for the same period in 2011-12.

This net decrease in spending is a combination of a decrease in Vote 1 - Operating Expenditures ($9.0 million), an increase in Vote 5 - Grants and Contributions ($5.4 million), as well as a minor increase in Budgetary Statutory Authorities ($0.2 million).

For the most part, this difference is explained by decreases of $6.2 million in spending under personnel expenditures, including EBP from $31.6 million in the second quarter of 2011-12 to $25.4 million as of September 30, 2012. The decrease of 19.6% is mainly attributed to civilian severance pay and termination benefits of $5.7 million paid out in the second quarter of 2011-12, as a result of newly signed collective agreements. The decrease is also attributable to Pay-at-Risk expenditures of $1.0 million paid out in the second quarter of 2011-12 which were paid in the first quarter in 2012-13. Subsequently, these payments were applied against Payables at Year End (PAYE).

Other Operating expenditures decreased by $2.6M from $7.3 million in the second quarter of 2011-12 to $4.7 million as of September 30, 2012. This decrease of 35.4% is mainly attributed to a decrease in spending under professional and special services of $2.2 million. This reduction relates to the creation of Shared Services Canada (SSC), the closure of Audit Services Canada (ASC), expenditures related to the audit of contribution agreements for the reimbursement to provincial and municipal agencies for planning and operations costs related to policing and security of the G8 and G20 meetings in 2010 made in the second quarter of 2011-12. Timing differences in payments for legal services provided by Justice Canada are also a factor. The decrease is also attributable to a decrease in spending under transportation and communications of $0.5 million due to telecommunication services being transferred to SSC following its creation.

Transfer Payments increased by $5.4 million from $30.0 million in the second quarter of 2011-12 to $35.4 million as of September 30, 2012. This increase of 18.0% is mainly attributed to $3.5 million in spending under the Biology Casework Analysis Contribution Program attributable to a payment made to the Quebec forensic laboratory in the second quarter of 2012-13, which was paid in the first quarter of 2011-12 and $3.1 million in spending for one-time Ex Gratia payments to the families of passengers and crew members of Air India Flight 182, which were delivered by Service Canada who provide administrative support for the delivery of the Ex Gratia payments. There is also a $2.5 million increase in spending under the First Nations Policing Program in the second quarter of 2012-13. These increases were offset by a $3.8 million decrease in spending under the National Crime Prevention Strategy Program from $11.1 million in the second quarter of 2011-12 to $7.3 million as of September 30, 2012.

3.0 Risks and Uncertainty

The Department's mandate spans from public safety and security, intelligence and national security functions, social interventions for youth-at-risk, to readiness for all manner of emergencies. The Department is called to rapidly respond to emerging threats and ensure the safety and security of Canadians. It's ability to deliver its programs and services is subject to several risk sources, such as, the rapidly changing asymmetrical threat environment, its ability to respond to natural or man-made disasters, government priorities, and central agency's or government-wide initiatives. To deliver this mandate effectively, the collaboration of many departments and agencies, provincial and territorial governments, international partners, private sector and first responders is required. Without the collaboration of all these partners, the Department is at risk in the delivery of its mandate and objectives, making the effectiveness of these relationships crucial.

PS is currently facing a number of pressures against its authorities:

- Implementing initiatives associated with the Economic Action Plan 2012;

- Budget 2010 Cost Containment Measures that requires the Department to internally finance, on a permanent basis, the costs of wage increases resulting from collective agreements negotiated between 2010-11 and 2012-13;

- The transfer of responsibilities and funding to SSC;

- The consolidation of pay services into one Centre of Expertise (CoE) at Public Works and Government Services Canada (PWGSC) in Miramichi, New Brunswick; and

- The need to reallocate funds out of existing authorities to meet emerging priorities (i.e. Kanishka operating funds).

All these pressures further limit the Department's flexibility to reallocate funding to achieve expected results.

In recognition of this tightening fiscal environment, PS examined all of its departmental program spending, balancing resource allocations against identified priorities by shifting from lower to higher priorities. The Department continues to explore actions to mitigate and manage the impact of these efficiencies measures on the organization and the delivery of corporate services.

4.0 Significant changes in relation to Operations, Programs and Personnel

External Reporting

Vote Netted Revenue

On June 26, 2011, section 29.2 of the FAA received Royal Assent, providing legal authority to departments to provide internal support services to and receive internal support services from one or more other departments, including the provision of those services through collaboration amongst departments.

As a result, and as part of the 2011-12 Supplementary Estimates (C) process, PS has been granted Vote-Netted Authority up to a dollar limit that PS will request from Treasury Board on an annual basis as part of the Estimates Process. This authority allows PS to recover revenues associated with the cost of providing these services and, in return, respend these revenues in the provision of these services. In 2012-13, the dollar limit request will be part of the Supplementary Estimates (B) process.

Statement of Management Responsibility for Internal Control over Financial Reporting

The Department provided its first Statement of Management Responsibility for Internal Control over Financial Reporting for 2011-12 in August of this year. This statement provides summary information on the measures taken by PS to maintain an effective system of internal control over financial reporting (ICOFR). Annex to the Statement of Management Responsibility contains a five year plan for how the Department will achieve compliance with the requirements set out in the Treasury Board Policy on Internal Controls. The Annex can be found at the following link http://www.publicsafety.gc.ca/cnt/rsrcs/pblctns/dprtmntl-prfrmnc-rprt-2011-12/index-eng.aspx within the Departmental Performance Report (DPR).

Regional Transformation

An objective of the regional transformation is to strengthen the overall contribution of the Department's regional offices. The new model will see better integration of the Department's work, which will allow it to better set priorities across the regions and deliver its work in a unified way. In tandem, the Department is also focusing on adopting a Functional Management Model to enhance service delivery across the Department through a holistic, coordinated and consistent approach and by capitalizing on the Department's full resource capacity, including regions.

Bringing teams of regional employees together provides immediate and long term benefits for knowledge transfer, enhanced communications and learning opportunities and enhanced service delivery at the local level. It provides new opportunities for collaboration, integration and efficiencies. This also helps to support a new streamlined regional operations structure, decision-making and corporate service delivery while maximizing the use of regional staff to support departmental priorities.

The first phase of consolidation of PS's regional offices was completed in the first quarter of 2012-13 with the formation of five regional headquarter offices and the staffing of four of the five Regional Director (EX-01) positions. The reduction of the number regional offices is well underway to reach a consolidated physical presence in the regions (from 30 to 15 regional locations) - some offices have already been consolidated, and the remaining projects are planned to be completed by the end of 2014-15. These ongoing changes are an important element in establishing the Department's new regional presence while finalizing the regional transformation component of the 2009 Strategic Review.

Transformation of Pay Administration

The Consolidation of Pay Services Project was approved by Treasury Board Ministers in June 2009 as part of the Transformation of Pay Administration Initiative. The Project will consolidate pay services from participating departments and agencies (organizations) that currently use, or are planning to use, the Government of Canada Human Resources Management System (PeopleSoft). The Department's reference levels will be adjusted as pay services are progressively transferred to PWGSC.

The implementation strategy started in 2011-12. One of the key components of the funding strategy is that work is transferred in a gradual, measured and deliberate manner, and that the amount of funds is proportionate to the number of accounts being serviced for the Project and the ongoing operations of PWGSC's CoE.

Authorities in Vote 1 - Operating Expenditures totalling $0.6 million will gradually be transferred through Supplementary Estimates and ARLU processes over a three year period ending in 2013-14. A total of $0.4 million was transferred to PWGSC's CoE in the first quarter of 2012-13 through the Supplementary Estimates (A).

Budget 2012 Implementation

This section provides an overview of the savings measures announced in Budget 2012 that will be implemented in order to refocus government and programs; make it easier for Canadians and business to deal with their government; and, modernize and reduce the back office.

Public Safety Canada (PS) is doing its part to support the federal government's return to a balanced budget, reduce the deficit, and deliver on its commitments to Canadians.

The Department will achieve Budget 2012 savings of $24.7 million by fiscal year 2014-15 through organizational restructuring as well as by transforming some of its business activities, while also minimizing service reductions to priority policies and programs.

Savings will be achieved in 2012-13 by reducing spending and by deriving savings from business transformation and organizational restructuring. There were no significant financial impacts in the second quarter on the department's authorities due to Budget 2012 decisions. The balance of the 2012-13 Budget 2012 savings will be reflected in subsequent quarterly financial reports.

The Department has developed action plans for all initiatives and is closely monitoring their implementation in order to ensure that all risks are mitigated. The initiatives arising from Budget 2012 will further enable PS to focus its resources on the Department's key priorities and core mandate, while at the same time ensuring we continue to keep our streets and communities safe.

Disaster Financial Assistance Arrangements

The Disaster Financial Assistance Arrangements (DFAA) Program was established in 1970 to provide a consistent and equitable mechanism for federal sharing of provincial or territorial costs for natural disaster response and recovery where such costs would place an undue burden on a provincial or territorial economy.

Since the inception of the program, the DFAA has been applied to over 180 events with a total federal payment to date of $2.18 billion. From 1970 to 1995, the total amount of DFAA payments averaged approximately $10 million per fiscal year. The 1996 Saguenay Flood, the 1997 Red River Flood and the 1998 Ice Storm resulted in large DFAA payments to affected provinces. DFAA payments of over $1.1 billion were made for these three events. Since 1996, DFAA payments have averaged $110 million per year.

There are currently over 60 natural disasters for which Orders-in-Council (OiCs) have been approved, authorizing the provision of federal financial assistance under DFAA, and for which final payments have not yet been made. Much of this outstanding federal share results from recent natural disasters. In 2010, there were an exceptional number of natural disasters for which provinces and territories requested federal financial assistance and the estimated federal share for these events alone is over $400 million.

Taking into account all the expected DFAA final payments, the total estimated outstanding federal liability in the second quarter is currently $1.25 billion (to be paid out over the next 5 years). The four most significant events, which represents over 50% of PS's liabilities, are the 2011 Manitoba Floods estimated at $347 million, the Saskatchewan 2007 Spring Summer Flood at $138 million, the 2010 Alberta June Rainstorm at $90 million and the 2010 Hurricane Igor that affected Newfoundland at $82 million.

Remembering Air India Flight 182

In addition to the four memorials erected, the federal Government has introduced the Kanishka Project and Air India Flight 182 Ex Gratia Payment as a way to honour the memory of the victims.

- Kanishka Project: On May 30, 2012, the Government of Canada announced the first round of funding, worth $1.1 million, awarded under the Kanishka Project. The primary focus of this $10 million multi-year investment is to support research on terrorism and counter-terrorism, along with related activities to build knowledge and create a network of scholars and students that spans disciplines and universities.

- Air India Flight 182 Ex Gratia Payment: One-time Ex Gratia payment to the families of passengers and crew members of Air India Flight 182 will be provided by PS in 2012-13 with funding in the amount of $7.9 million. PS has secured the assistance of Service Canada to provide administrative support for the delivery of the Ex Gratia payment.

Transfer to Security Intelligence Review Committee - To consolidate the review functions of the Canadian Security Intelligence Service into a single organization

Following Budget 2012 decisions, Parliament passed the Jobs, Growth and Long-term Prosperity Act, in June 2012. As directed by the Act, the Government of Canada consolidated the review functions of the inspector General with those of the Security Intelligence Review Committee (SIRC) - an independent external review body which reports to the Parliament of Canada on the operations of CSIS. The core oversight responsibilities of IG-CSIS will be transferred to the SIRC while Public Safety Canada will assume a greater responsibility for providing independent advice to the Minister of Public Safety. The budget transfer will be done through the 2012-13 Supplementary Estimates (B).

Ultimately, consolidating the review functions into a single organization by transferring responsibility for the annual Certificate to the Minister from IG to the SIRC will eliminate duplication and reduce federal spending while ensuring the same level of accountability for CSIS activities.

Approval by Senior Officials:

Graham Flack A/Deputy Minister

Ottawa, Ontario

Gary Robertson, Chief Financial Officer

Ottawa, Ontario

| Fiscal year 2012-2013 | Fiscal year 2011-2012 | ||||||

|---|---|---|---|---|---|---|---|

| Total available for use for the year ending 31/03/2013* ** | Used during the quarter ended September-30-12 |

Year to date used at quarter end September-30-12 |

Total available for use for the year ending 31/03/2012* | Used during the quarter ended September-30-11 |

Year to date used at quarter end September-30-11 |

||

| Vote 1 - Operating expenditures | 135,082 | 26,340 | 53,432 | 143,586 | 35,346 | 63,032 | |

| Vote 5 - Grants and contributions | 251,940 | 35,381 | 126,026 | 263,562 | 29,993 | 64,700 | |

| Budgetary statutory authorities | 15,134 | 3,784 | 7,567 | 14,365 | 3,585 | 7,176 | |

| Total Authorities | 402,156 | 65,505 | 187,025 | 421,513 | 68,924 | 134,908 | |

*Includes only authorities available for use and granted by Parliament at quarter-end

** Total available for use does not reflect measures announced in Budget 2012

Note: Totals may not add and may not agree with details provided elsewhere due to rounding.

| Fiscal year 2012-2013 | Fiscal year 2011-2012 | |||||||

|---|---|---|---|---|---|---|---|---|

| Planned expenditures for the year ending 31/03/2013* | Expensed during the quarter ended September 30, 2012 | Year to date used at quarter end September 30, 2012 | Planned expenditures for the year ending 31/03/2012* | Expensed during the quarter ended September 30, 2011 | Year to date used at quarter end September 30, 2011 | |||

| Expenditures: | ||||||||

| Personnel | 103,242 | 25,417 | 52,902 | 93,742 | 31,645 | 58,143 | ||

| Transportation and communications | 7,994 | 815 | 1,432 | 11,855 | 1,267 | 2,379 | ||

| Information | 1,500 | 288 | 337 | 2,413 | 359 | 476 | ||

| Professional and special services | 22,702 | 1,749 | 3,263 | 32,111 | 3,962 | 5,848 | ||

| Rentals | 5,393 | 825 | 1,822 | 7,867 | 935 | 2,077 | ||

| Repair and maintenance | 1,566 | 443 | 521 | 1,182 | 327 | 471 | ||

| Utilities, material and supplies | 1,321 | 121 | 217 | 2,299 | 169 | 269 | ||

| Acquisition of land, buildings and works | 1,555 | - | - | 233 | - | - | ||

| Acquisition of machinery and equipment | 4,865 | 460 | 496 | 6,151 | 259 | 525 | ||

| Transfer payments | 251,940 | 35,381 | 126,026 | 263,562 | 29,993 | 64,700 | ||

| Public debt charges | - | - | - | - | - | - | ||

| Other subsidies and payments | 78 | 6 | 9 | 100 | 7 | 20 | ||

| Minus: Funds available | ||||||||

| Total budgetary expenditures | 402,156 | 65,505 | 187,025 | 421,513 | 68,924 | 134,908 | ||

* Planned expenditures do not reflect measures announced in Budget 2012

Note: Totals may not add and may not agree with details provided elsewhere due to rounding.

- Date modified: